1 Introduction

REI is a national outdoor retail co-op committed to

educating and outfitting its members and the community for outdoor adventures

and stewardships. REI offers their own line of high-quality award-winning gear

and apparel. This retail store also has top brands for camping, climbing,

cycling, fitness, paddling, snow sports, and travel. REI is dedicated to

promoting environmental stewardship as well as providing access to outdoor

recreation. REI started as a cooperative (co-op) in 1938. Instead of being a

publically traded company, REI focuses on long-term interests of the co-op and

its members. Anyone can shop at REI, but the co-op members pay a $20 for a

lifetime membership to gain a portion of the profits each year based on a few

requirements. REI operates a business that impacts the growing outdoor

participation and protects the environment for future generations.

1.1 Study

Area

The area for this site selection will be looked at in Appleton, WI. Brown, Outagamie, Winnebago, and Calumet Counties are going to be contributing factors to the site selection as well as the defined study area (Figure 1). These counties contain come other major cities that could be beneficial or competitive for Appleton such as Green Bay and Oshkosh.

1.2 Purpose of this Study

Around the study area, there

are not many close REI locations. The primary spots are around Minneapolis-St.

Paul, MN, Madison and Milwaukee, WI, and Chicago regions (Figure 2). REI wants

to see if there are any locations that are worth putting a new location in

northern Wisconsin.

|

| Figure 2. Locations of REI in MN, WI, and IL. |

Looking more into the metropolitan statistical areas (MSA) of Wisconsin, a claim can be made for the defined study area above. For example, Figure 3

contains a map of the metropolitan areas in Wisconsin. Current locations are

located in the Minneapolis-St.

Paul-Bloomington, Madison, Milwaukee-Waukesha-West Allis, and Chicago-Naperville-Elgin metropolitan

statistical areas. Just around the city of Appleton, there is the Appleton, Green Bay, and Oshkosh-Neenah MSA. The MSA that

surround the city of Appleton are in a close proximity to potential locations

for REI sites.

|

| Figure 3. Metropolitan and Micropolitan Statistical Areas of the US (US Cenus 2015). |

1.3 Scope

of this study, sources, and methods

To understand the study area, a series of analyses will be completed, including: assessing the demographics of the study area, locating ideal customers, identifying trade areas, assessing the market structure, and selecting three sites and ranking them. Specifics of the demographics include the total populations, population density, and breaking down the age cohorts using the 2010 census data. The ideal customers tool uses a method that identifies the threshold of some variable at a geographic area such as zip codes. The market structure can then identify potential competitors if REI were to move into the city of Appleton. This will show if market saturation is a concern.

Retail Gravity Theory suggests that there are consistences in the behavior of shoppers. This can be determined with a mathematical analysis to make a prediction based on the concept of gravitation from a particular location. This relates to the point of indifference, which is the extremity of a city's trading area where households would be indifferent between shopping in that city (Appleton) and a different city. This gravity model will be used to relate to surrounding cities. This looks at potential cities such as Green Bay, Oshkosh, and Greenville.

And lastly, ranking sites allows one to see which sites could potentially out perform the others. The sites need to be selected based on an area that would be large enough for a REI to actually be built, not just a general location. A 1.5 mile buffer will surround the potential sites and must meet certain criteria in order to be selected.

Retail Gravity Theory suggests that there are consistences in the behavior of shoppers. This can be determined with a mathematical analysis to make a prediction based on the concept of gravitation from a particular location. This relates to the point of indifference, which is the extremity of a city's trading area where households would be indifferent between shopping in that city (Appleton) and a different city. This gravity model will be used to relate to surrounding cities. This looks at potential cities such as Green Bay, Oshkosh, and Greenville.

And lastly, ranking sites allows one to see which sites could potentially out perform the others. The sites need to be selected based on an area that would be large enough for a REI to actually be built, not just a general location. A 1.5 mile buffer will surround the potential sites and must meet certain criteria in order to be selected.

2 Findings and Discussion

2.1 Demographics

In 2010 US Census, the City of Appleton contained a

population of 72,623 people. In 2015, the Wisconsin Department of Administration

estimated 73,737 residents in Appleton. It is projected that Appleton will have

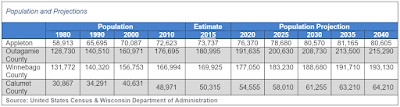

a steady increase in population. Figure 4 compares Appleton to three of the

counties in the study area. This is beneificial to a potential growing market.

|

| Figure 4. Population and Projections for the Study Area (US Census & WI Department of Administration). |

Looking at the age distribution of Appleton (Figure 5), 63.66% of the population is within the working class based

on the 2010 Census. The median age for Appleton is 35.3 years old. This age is great for consumerism for this type of activity because the population is young enough to engage in such activities as well as be able to afford it by having a high percentage of a working population. Compared to

surrounding large cities such as Oshkosh and Green Bay, Appleton has a higher

percentage of the age cohort of 14 and under. Appleton also has a higher

percentage of working adults in the 35 to 44 and 45-54 age cohorts

comparatively.

|

| Figure 5. Age Distribution of the City of Appleton (US Census 2010). |

Figure 6 looks specifically at

where the population is most dense. Like many situations for metropolitan areas, the population tends to be located closest to the downtown or the central city. To the west of Appleton are suburbs like Grand Chute that provide the location to the Fox River Mall as well as many of the other retail industries.

|

| Figure 6. Appleton Population Density (Appleton Comprehensive Plan 2015). |

2.2 Ideal Customers

Typically the market for customers is in areas that are considerably more wealthy. Many of the 2010 Census tracts for this area have a considerable high or average median household income (Figure 7). Households that have an income of $45,000 and higher have a bigger influence on the consumer spending of Appleton. The darker green areas are predominantly located around the city boundary in more of the suburbs. However, they are still in close proximity to the city where the consumer spending is still going to have a high impact in the City of Appleton.

|

| Figure 7. 2016 Median Household Income based on Census Tracts in the Fox Valley. |

The ideal customers use a method that identies the variable at a geogrphic area. This included zip codes with a minimum of 20,000 people and a median household income of at least $45,000. The zip codes that met this critera surrounded the Oshkosh and Green Bay, shown in Figure 8. The fact that the potential sites are in between the two ideal customer areas is notable in reaching markets outside of Appleton.

|

| Figure 8. Customers prospecting in Winnebago and Brown County. |

2.3 Market Structure

Much of the competition for REI is sporting good stores (Figure 9). Some of the big competitors that appeared multiple times are Scheels and Dick's Sporting Goods. These two competitors offer a variety of sporting goods from hunting, athletics, and outdoor apparel. REI offers different products that are primarily for the consumer looking for camping and outdoor activities such as biking, hiking, etc. While there are competitors in close proximity, REI sells many products that it's competitors do not giving it more of an advantage to locate here.

|

| Figure 9. Competitors for REI. |

2.4 Trade Areas

The Trade Areas were expressed for REI in this location using Reilly's Law of Retail Gravitation. The factors that first needed to be determined were three cities in different directions of Appleton. Green Bay, Oshkosh, and Greenville will be assessed based on their population and distance from Appleton, shown in Table 1.

|

| Table 1. Factors used in the Gravitational Model. |

Using the formula, Table 2 shows the computed values for the retail gravitation. By taking the Distance from Appleton and subtract the calculated value, the point of indifference can be computed.

|

| Table 2. Computed Values for Reilly's Law of Retail Gravitation. |

Although this model does not account for every city that falls in between Appleton and the selected city, it can give a rough estimate of the distances that are willing to travel to Appleton. Figure 10 shows a triangulated area of area that would be willing to travel to Appleton that are in the midst of Green Bay, Oshkosh, and Greenville. Typically when this model is ran, cities are selected that have a lower population. However, in this case Green Bay has a larger population than Appleton. In the Fox Valley, Appleton, Green Bay and Oshkosh are similarly large cities and are located in a short distance of each other. The model was tested on Green Bay and Oshkosh specifically to predict how many would be willing to travel to Appleton if they lived near one of the other larger cities. Green bay is 35.6 miles away from Appleton, but based on it's point of indifference only 16.2 miles from Appleton to Green Bay would people be willing to shop in the City of Appleton. This leaves 19.4 miles leaning more towards shopping in Green Bay. But for those that are in Oshkosh, the distance is near half way that would be willing to travel to Appleton.

|

| Figure 10. Model of the Retail Gravitation based on miles. |

2.5 Rank Sites

These sites that were selected were on empty lots in commercial areas within Appleton. With a 1.5 mile buffer around the four sites, variables were considered in order to see which sites may outperform others (Figure 11). The variables included 2016 Total Income, 2016 Median Household Income, and Outdoor stores. The sites were located in different developing areas around Appleton. One area was located in Appleton East, which is a Secondary Business District (SBD). This area was established and built up even more as the suburbs outside of Appleton grew in population and a Walmart was placed next to the many residential areas. The Appleton North location that consists of a newly developed business district. This area also includes other recreational uses and many housing developments growing in the back of it. The other two sites that were placed on the west side of Appleton are in close proximity to the Fox River Mall. The one on the lower half is closer to Greenville, WI which is a city that has trend of population increase. Many businesses are moving to this are for future business development and it is on the outer bounds of the retail area established with the mall. The last location is around the areas where there is more outlet shops, a minor league baseball stadium, and it is in an area that can create competition with Dick's Sporting Goods and Scheels.

The location in Appleton North was the ranked as the number one site for REI to locate. There is not as much competition in this area. The people that live around that area tend to be in wealthier households. This area also has been developing greatly out to the Freedom and Mackville areas. The site that was ranked the lowest could be due to the fact that the suburbs that surround this area to the east have a lower population and potential income as well.

The location in Appleton North was the ranked as the number one site for REI to locate. There is not as much competition in this area. The people that live around that area tend to be in wealthier households. This area also has been developing greatly out to the Freedom and Mackville areas. The site that was ranked the lowest could be due to the fact that the suburbs that surround this area to the east have a lower population and potential income as well.

|

| Figure 11. Potential REI locations based on rank. |

3 Conclusions

Based on the findings in the geospatial analyses, the following conclusions were summarized:

- Appleton has a younger population than Oshkosh or Green Bay, a larger working class, and a population that is projected to continue increasing.

- These potential locations are also in between the two ideal customer areas.

- There is not as large of a competition compared to other large cities that surround Appleton. However, based on what the competition does sell, REI offers different products then well known places like Dick's or Scheels sell. They focus on all different types of sports, hunting, fishing, etc. REI specializes in different outdoor activities such as biking, hiking, water sports, etc.

- Cities with smaller populations that are closer in proximity to Appleton are more likely to have more of their population shop in Appleton, compared to Green Bay that has a higher population and less likely have more people shop in Appleton than Green Bay.

- There is a large population of people that have a high median income around the suburbs of Appleton.

4 Recommendations

After assessing the different dynamics of study site, the following recommendations were created in order to provide the best possible suggestion for a new REI location.

- Appleton would be a great location because it is a MSA that is between large cities including: Green Bay, Oskhosh, Neenah, etc.

- The site that was ranked number one would be beneficial for REI to locate at because of the future development. This area is currently growing it's business district, residential areas, and recreational opportunities. It is considered the newer part of Appleton. It is also not that far from the downtown. This location is also very close to I-41 as well as Highway 441.

- The age of the population is great market. Majority of the populaiton is between 25 and 54. This age is part of the working class so the income could be spent on buying equipment for recreational uses. The population is also in an independent and capable age that would engage in outdoor activities.

- A market for families could also be beneficial because of the high population of children under the age of 14.

5 References

City of Appleton. (2015). Appleton Comprehensive

Plan. Retrieved from Envision Appleton: http://www.envisionappleton.org/

ESRI. 2016. "Esri Business Analyst."

REI Co-op. (2017). REI Overview. Retrieved

from REI: https://www.rei.com/about-rei/business.html

US Census Bureau. (2015, July). Metropolitan and

Micropolitan Statistical Areas of the United States and Puerto Rico.

Retrieved from US Census:

https://www2.census.gov/geo/maps/metroarea/us_wall/Jul2015/cbsa_us_0715.pdf

No comments:

Post a Comment